Your accounts payable and cash flow are closely intertwined. As you pay off your accounts payable or increase your accounts payable with credit purchases, your cash flow is being affected.

Below we cover how accounts payable impacts your cash flow.

Key takeaways

- Effectively managing accounts payable can significantly improve cash flow.

- Accounts payable, listed as a current liability, need careful management to ensure financial health and operational liquidity.

- Key strategies include negotiating favorable payment terms with suppliers to extend cash retention and using automation to streamline invoice processing.

- Improving the speed and accuracy of invoice processing directly impacts the efficiency of accounts payable management, improving cash flow.

- Practices like early payment discounts and clear payment terms motivate timely payments, aiding cash flow.

- Using automation tools like Plooto simplifies AP, enhancing payment scheduling and financial visibility.

Accounts payable and how they're related to cash flow

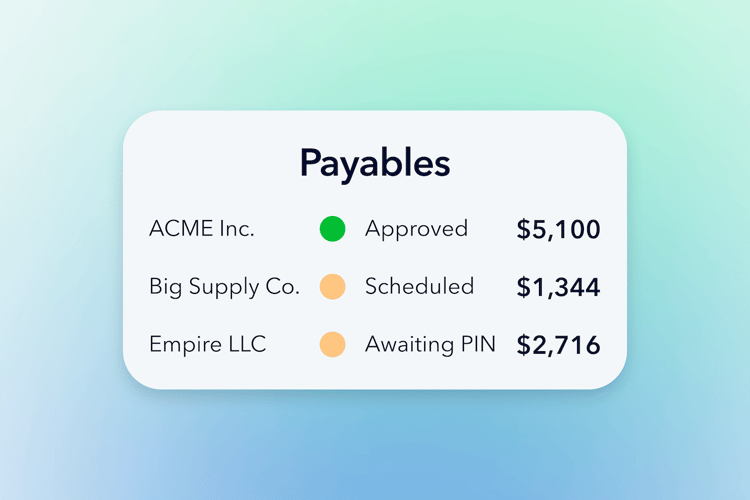

Accounts payable (AP), or payables, are the company's short-term debts to another party. Simply, your accounts payable balance represents the money your business currently owes.

AP will show up on your balance sheet as a current liability, as payables are a short-term liability lasting up to a year.

Likewise, accounts receivable also impacts cash flow.

How an increase in accounts payable affects cash flow

Though it may seem counterintuitive, an increase in accounts payable leads to a positive cash flow.

An increase in your AP balance is a sign you're making more purchases on credit, and not immediately spending cash. Therefore, you're not having cash outflows, leading to a positive cash flow.

How a decrease in accounts payable affects cash flow

A decrease in accounts payable creates a negative cash flow. This occurs because you're using cash to pay off short-term debts, resulting in cash outflows.

What's the difference between cash flow and accounts payable?

Your cash flow is cash inflows and outflows, tracking where cash goes and where it comes from. The company's cash flow is only impacted by the cash used. On your cash flow statement, accounts payable aren't included.

Your accounts payables are purchases made on credit — not immediately using cash — and therefore are not a cash outflow. Though accounts payable balance is decreased by using cash to pay suppliers, the balance itself isn't considered a part of cash flow.

The flow of accounts payable

The flow of accounts payable, or the AP process, lays out the steps from ordering a product to paying for the product. An example of a simplified AP process could look like this:

- An order is made for goods/services, and a document called a purchase order is created.

- An invoice is received and the accounting books are updated with an accounts payable balance according to the price of the order made. The purchase order and invoice are cross-listed to ensure accuracy.

- Goods/services are received and a three-way match is made between the purchase order, invoice, and receipt.

- Payment authorization is undertaken.

- Cash is used to make a payment to the supplier, and the accounting books are updated to reflect a decrease in cash and an expense made.

Further reading: The AP turnover ratio explained simply

How to manage accounts payable to improve cash flow

Efficient management of your accounts payable can help to improve your cash flow. Consider negotiating better payment terms which would enable you to hold onto cash longer, meaning you can use cash on hand elsewhere.

Be careful not to miss due dates for payment though, as this can result in late payment fees and hurt the relationship with your suppliers.

-min.png?width=1750&height=1167&name=2%20(1)-min.png)

Best ways to improve cash flow management

Improve invoice processing time

The faster you can process invoices, the faster you can understand where cash needs to go, and when. There are a few ways you can improve your invoice processing time:

- Automate data capture: Manually inputting data from invoices can be a time-consuming process. Consider implementing an automated data capture, which will automatically input data from invoices for you — saving you major time. There are many automation tools to help with this process, including Plooto.

- Reduce human error: Errors in invoice data can cause havoc in your process, causing you to have to chase down invoice senders, or re-do data entry. Automation reduces manual processes, leading to fewer errors in invoice management.

- Streamline your workflow: Make your invoice process streamlined by ensuring the steps are consistent and repeatable, with any roadblock effectively managed.

Improve visibility of committed spend

Your committed spend is the costs associated with goods/services you agree to purchase in a period of time. It represents your commitment to pay for goods of a certain amount in a certain amount of time.

By improving the visibility of committed spending you'll be able to quickly see:

- What was purchased

- How much was/will be spent

- Who you bought it from

- Who did the buying

To improve spending visibility consider implementing:

- Clear policies around who is buying, how much, how often, and how to manage spending.

- Analysis and reporting tools can help create a dashboard that easily visualizes your spending, allowing you to make data-driven decisions.

Properly account for GRNI

Goods Received Not Invoice, or GRNI, is a record made in your accounting books that shows you have received the goods/services but are lacking a corresponding invoice. Without an invoice, you can't make a record in your accounts payable, so in this situation, it is recorded in the GRNI account.

If your GRNI is too high this can signal a few issues, like overstated inventory, missing supplier payments, and overstatement of liabilities.

Ensure you have policies to manage GRNI, so you can quickly receive the missing invoice and account for it properly in your AP. Getting a hold of the invoice is key to planning your cash flow for a period of time.

Have access to real-time reports

Access to real-time reports can provide vital insights into your cash flow, and where improvements can be made. Real-time data can be used to make data-driven decisions with better accuracy.

Reports can show in real time how cash flow has impacted your cash balance and can enable accurate forecasting and budgeting. Access to real-time reports can help determine if you have a healthy cash flow.

Use automation to better forecast your cash flow

Accounts payable automation can help you forecast your cash flow. AP automation reduces costs, minimizes human error, and helps to manage your accounts better.

Even though AP automation has the advantages of electronic invoicing and simplifying your accounting process, according to Ascend, only 39% of organizations have automated their AP processes.

Where accounts payable fit on a cash flow statement

Accounts payable activity goes under operating activities on a cash flow statement.

Operating activities is the first section of the cash flow statement.

The 3 main sections of a cash flow statement are operating Activities, investing activities, and financing activities.

Operating activities

Purchases made for operating activities like tax payments, interest, employee wages, etc. Cash flow from the costs of operating will fall under this section in the statement of cash flows.

Accounts payable falls under this section.

Investing activities

Any cash flow from investing activities like purchasing company assets/inventory, or loans made will go under investing activities.

Financing activities

Cash flow from financing activities like receiving cash from investors and dividends paid to investors falls under financing activities.

Other ways to improve cash flow

Make sure vendor and supplier payments are on time

Pay close attention to due dates, this way you can take advantage of early payment discounts and ensure you're paying on time. This will improve your vendor relationships, helping you to negotiate better payment terms in the future.

Invoice customers promptly

Send invoices as soon as possible to customers. This will help prompt faster payment, leading to quicker cash inflows.

Follow up early on unpaid sales invoices

Follow up early on unpaid invoices and don't wait until past due dates. Send friendly reminders to customers to help encourage on-time B2B payments.

Charge a late payment fee

Consider implementing a late payment fee to incentivize on-time payments.

Review company expenses regularly

Review your expense transactions regularly to make sure you know where and when your cash is moving. This can help forecast future cash flow, and ensure only necessary purchases are being made.

Automate accounts payable

Automation can drastically help you manage your AP. Automating your AP can help to reduce errors, save you time and money, give better insights, and help standardize your AP process.

Plooto lets you automate your AP in a way that's customizable to your business needs.

With an automation tool, you can create custom approval workflows, eliminate manual processes, schedule payments, and get visibility into your cash flow.

Plooto specifically can save you time and money by automating your AP process and eliminating tedious manual processes.

FAQs about accounts payable and cash flow

Where do accounts payable go?

Accounts payable go on the company's balance sheet, under current liabilities. Your AP represents money owed to creditors, and so it's a current liability.

How do liabilities affect cash flow?

An increase in liabilities will create a positive cash flow, as cash isn't being used to purchase.