Managing cash flow effectively is an essential aspect of running a business smoothly. However, many small businesses struggle with cash flow management, especially if they don’t have a lot of experience in bookkeeping and accounting.

As any business grows, increased payment complexity can make it hard to track your cash inflows and outflows. So what’s the best way to review your cash flow and get a snapshot of where your business stands?

One great way to get insight into the financial health of your business is by using a cash flow statement. Let’s walk through what cash flow is and how to create your own cash flow statement.

What is cash flow and why is tracking cash flow important?

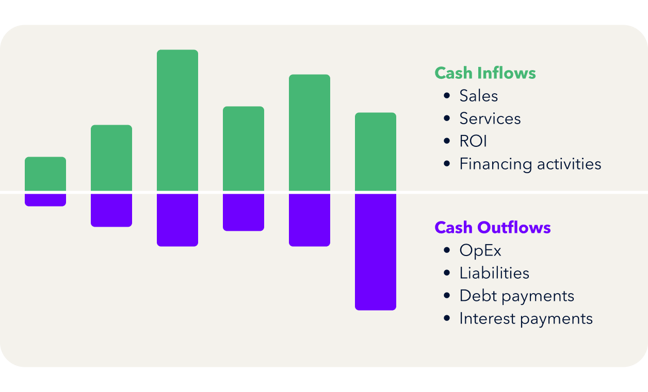

Cash flow is the total amount of money flowing in and out of your business. Cash inflows may come from sales of products or services, investment returns, or financing. Cash outflows occur when you move money out of your business to pay operating expenses, debt, and other liabilities.

Understanding cash flow allows you to keep adequate funds on hand for basic needs while enabling you to take advantage of growth opportunities.

Tracking your cash flow gives you visibility into your business and helps you make more informed decisions. With a better understanding of where your business stands, you can make strategic choices about when and how to fuel business growth and decide where to cut costs to improve profitability.

Cash flow statements

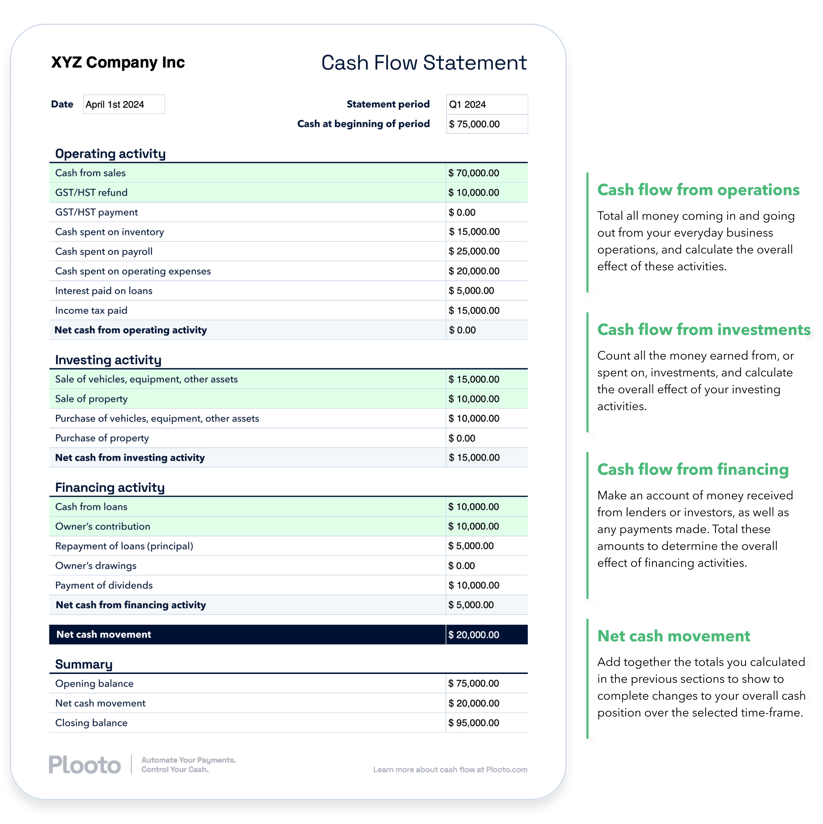

One of the best ways to track your cash is to create a cash flow statement. A cash flow statement tells you exactly how much cash is entering and exiting your business in a given period. Cash flow statements provide granular detail by focusing on three key sections: Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

What can you learn from a cash flow statement?

Cash flow statements provide a snapshot of your business’s financial health and help you make more informed decisions. A statement can provide data on whether your inflows and outflows are in balance, which of your products are growing the fastest, which parts of the business generate losses, and how seasonality affects your business.

Having a current understanding of your cash flow helps you improve cash flow in the future and make better use of cash in hand.

Let's get to what a cash flow statement consists of and how you can generate one for your business.

Generating a cash flow statement

A cash flow statement is generally generated for a specific period, like a month or a quarter. In our example, the cash flow statement for “XYZ Company Inc” has been divided into four main sections:

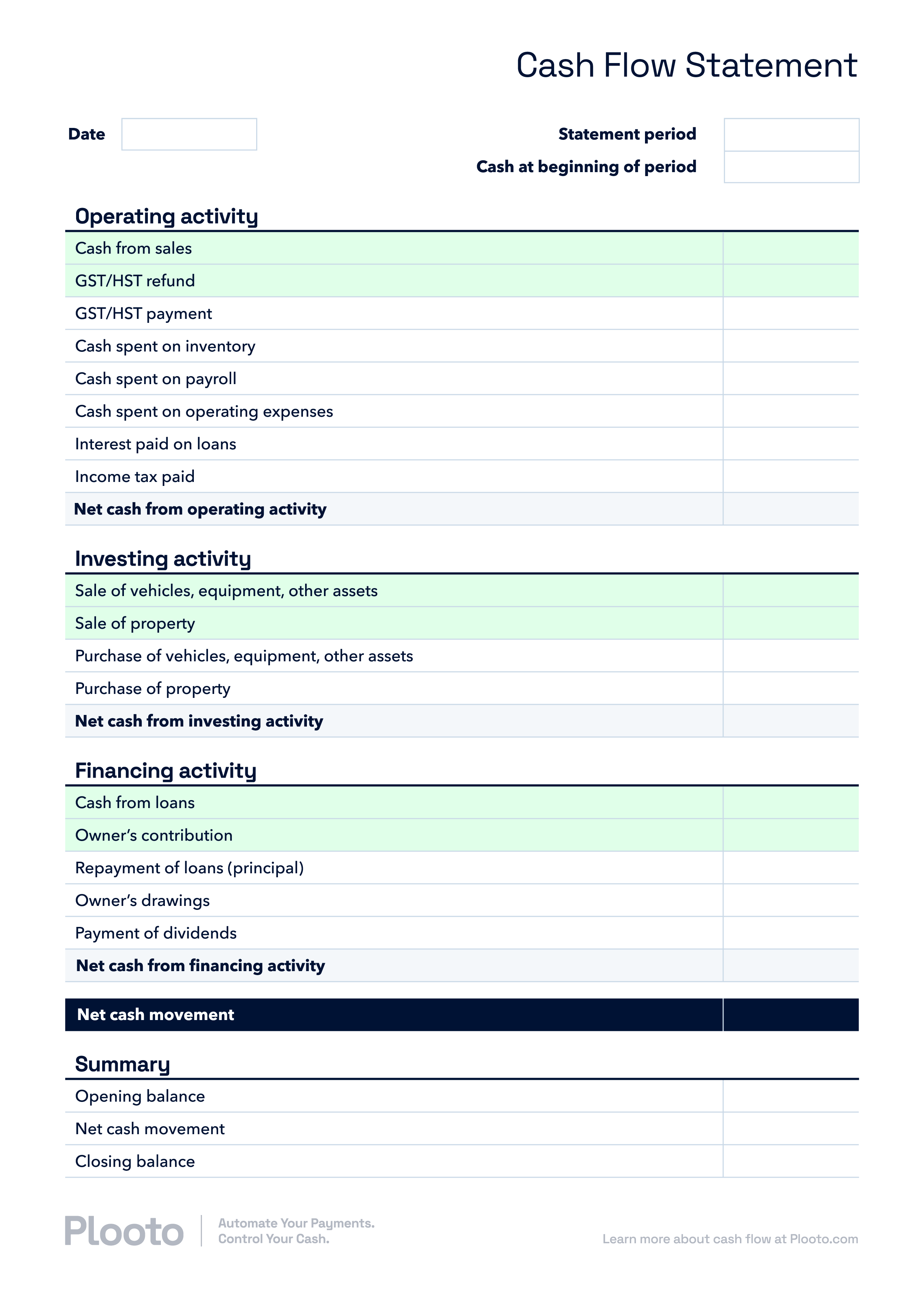

Download our free cash flow statement template

Ready to get started on your new cash flow statement? Download our free template!

Download template

Understanding cash flow is key to the future success of your business

Small businesses can boost efficiency, improve overall decision-making, and accelerate growth by tracking their finances using cash flow statements.

You can also get a clearer picture of your cash flow status by introducing automation to your overall AP and AR processes. Automation helps you eliminate manual data entry errors, provides real-time data on your finances, and helps you cut costs. Plus, it can streamline your entire payment process and help you save time so that you can spend time on other parts of your business — or your life.

Ready to fully master your cash flow management? Read our full guide to future-proofing your small business cash flow for more tips and recommendations.